Advance Import Payments (APN)

Importers and Traders are now required to notify SARS through its e-filing platform when they intend to make a foreign payment for goods still to be imported. Upon notification, the importer will receive an Advanced Payment Notification (APN) reference number. The advance payment notification system aims to prevent the undervaluation of customs duties and taxes, as well as illicit financial payments.

Who will need to get this, and when?

- Importers paying invoices over a value of R50 000.

- When payments for goods are required before customs clearance into South Africa.

What is required to apply?

- Importer has to be registered on the SARS e-filing platform.

- The importer has to be registered with SARS Customs as an Importer.

- A commercial invoice or pro-forma invoice from the foreign supplier, detailing the intended supply of goods.

How to obtain an APN reference number on e-filing?

- Log into your e-filing profile and navigate to the relevant entity.

- Click on the Customs tab in the top right bar.

- Click on the “Advance Payment Notification” on the left side menu.

- Click on the “Submit New Advance Payment Notification” option.

- Capture the information required on the APN form and press continue.

You will immediately receive a SARS-generated APN reference number upon successful completion. One APN number is required per advance payment over R50 000. If more than one payment is required before customs clearance, then the APN numbers should be linked on e-filing when applying for the additional numbers.

What does the importer need to know?

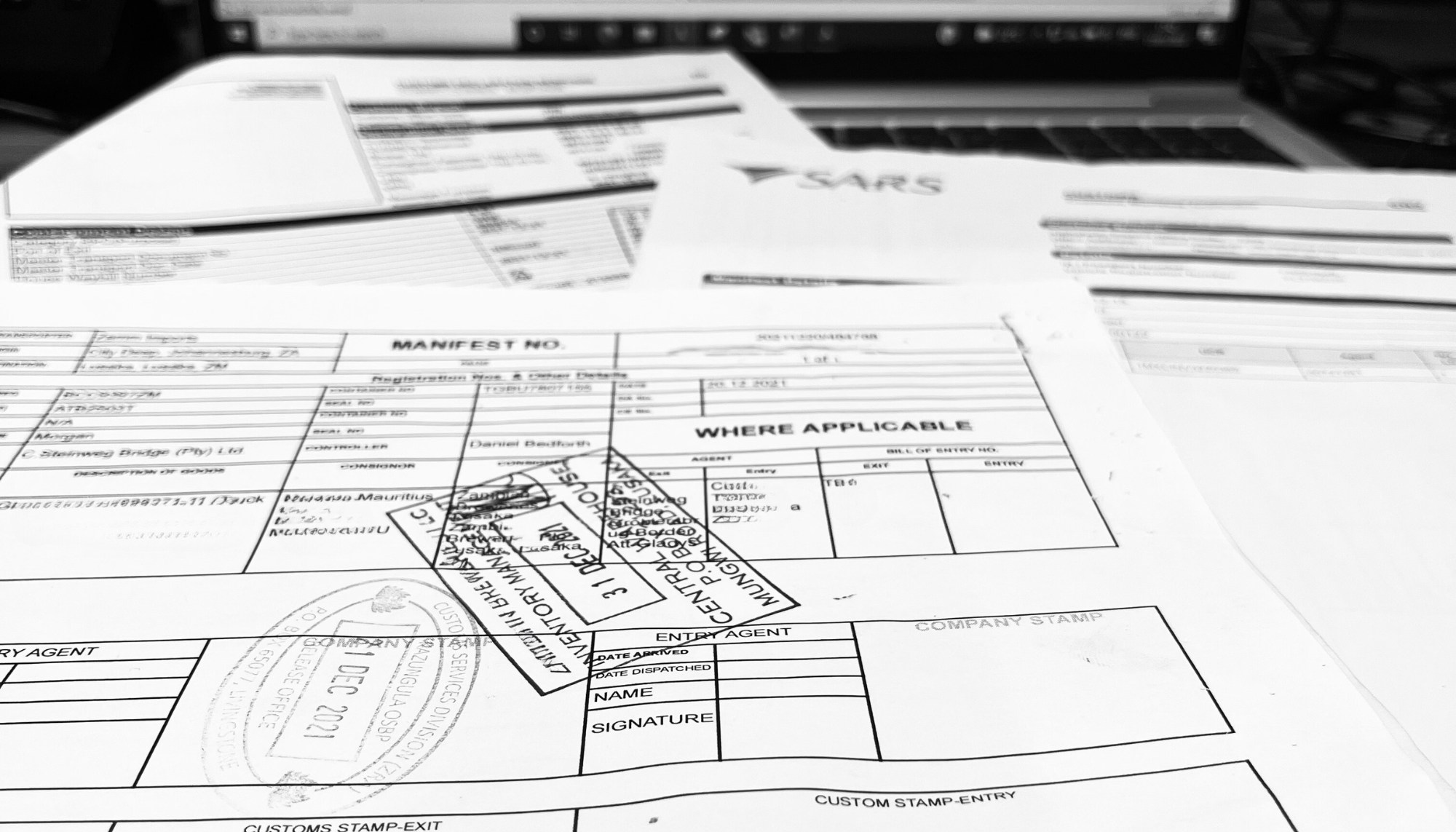

- Importer to ensure the APN number is stipulated on the clearing instruction for endorsement on the Customs Bill of Entry.

- Released Bill of Entry, along with shipment documentation pack, are to be submitted to the bank within 4 months of the APN number being issued.

Please reach out to our Customs team should you need further clarification: customs@za.steinweg.com